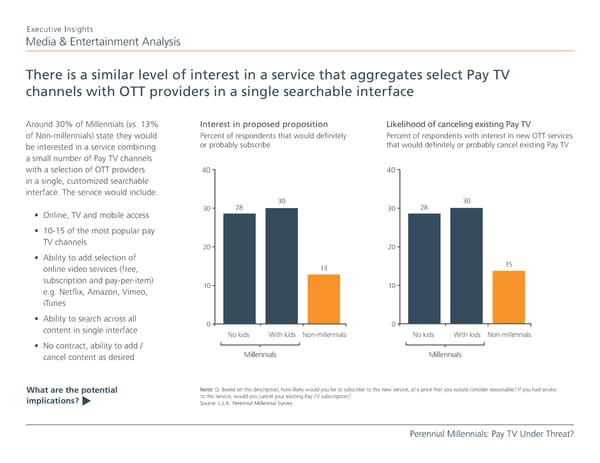

Executive Insights Media & Entertainment Analysis There is a similar level of interest in a service that aggregates select Pay TV channels with OTT providers in a single searchable interface Around 30% of Millennials (vs. 13% Interest in proposed proposition Likelihood of canceling existing Pay TV of Non-millennials) state they would Percent of respondents that would definitely Percent of respondents with interest in new OTT services be interested in a service combining or probably subscribe that would definitely or probably cancel existing Pay TV a small number of Pay TV channels with a selection of OTT providers 40 40 in a single, customized searchable interface. The service would include: 30 30 30 28 30 28 • Online, TV and mobile access • 10-15 of the most popular pay TV channels 20 20 • Ability to add selection of online video services (free, 13 15 subscription and pay-per-item) 10 10 e.g. Netflix, Amazon, Vimeo, iTunes • Ability to search across all 0 0 content in single interface No kids With kids Non-millennials No kids With kids Non-millennials • No contract, ability to add / cancel content as desired Millennials Millennials What are the potential Note: Q: Based on this description, how likely would you be to subscribe to this new service, at a price that you would consider reasonable? If you had access to this service, would you cancel your existing Pay TV subscription? implications? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

Perennial Millennials Page 10 Page 12

Perennial Millennials Page 10 Page 12