Perennial Millennials

Pay TV Under Threat?

Executive Insights Media & Entertainment Analysis Perennial Millennials: Pay TV Under Threat? L.E.K.’s analysis, “The Perennial Millennial,” is the first in-depth review of U.K. Millennials’ media consumption, covering six life stages, from living at home with parents all the way through to starting their own families. In the second installment of the Executive Insights Media & Entertainment Analysis: “The Perennial Millennial” series, L.E.K. explores the following questions: • What is the uptake of and future interest in Over-The-Top (OTT) services among Millennials by life stage? • What is the potential future impact on traditional Pay TV providers? What do Millennials’ TV and video consumption patterns look like? t The Perennial Millennial research and analysis was conducted by Maria Palm and Martin Pilkington, both partners in L.E.K.’s European Media, Entertainment and Technology practice. Maria and Martin are based in London. For more information, please contact [email protected].

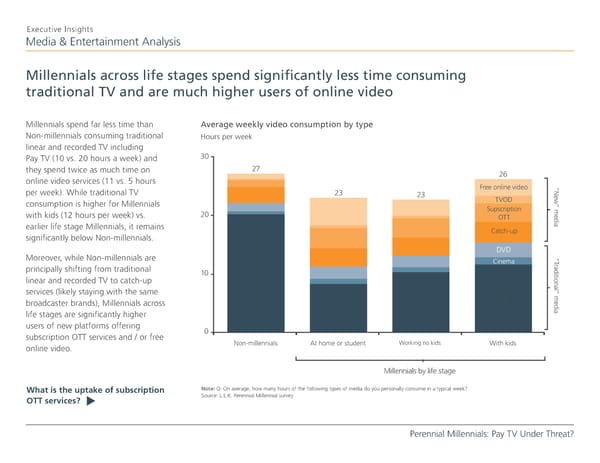

Executive Insights Media & Entertainment Analysis Millennials across life stages spend significantly less time consuming traditional TV and are much higher users of online video Millennials spend far less time than Average weekly video consumption by type Non-millennials consuming traditional Hours per week linear and recorded TV including Pay TV (10 vs. 20 hours a week) and 30 they spend twice as much time on 27 26 online video services (11 vs. 5 hours per week). While traditional TV 23 Free online video “N 23 e TVOD w consumption is higher for Millennials ” Supscription m with kids (12 hours per week) vs. 20 e OTT d i earlier life stage Millennials, it remains Catch-up a significantly below Non-millennials. DVD Moreover, while Non-millennials are “ Cinema T r a principally shifting from traditional di 10 t i o linear and recorded TV to catch-up n al ” services (likely staying with the same TV m e broadcaster brands), Millennials across di life stages are significantly higher a users of new platforms offering 0 subscription OTT services and / or free Non-millennials At home or student Working no kids With kids online video. Millennials by life stage What is the uptake of subscription Note: Q: On average, how many hours of the following types of media do you personally consume in a typical week? Source: L.E.K. Perennial Millennial survey OTT services? t Perennial Millennials: Pay TV Under Threat?

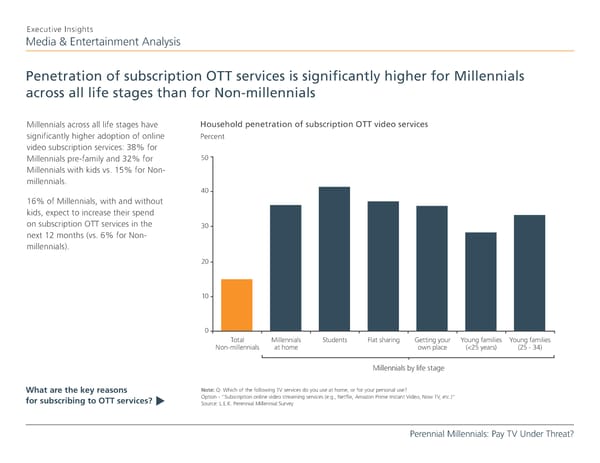

Executive Insights Media & Entertainment Analysis Penetration of subscription OTT services is significantly higher for Millennials across all life stages than for Non-millennials Millennials across all life stages have Household penetration of subscription OTT video services significantly higher adoption of online Percent video subscription services: 38% for Millennials pre-family and 32% for 50 Millennials with kids vs. 15% for Non- millennials. 40 16% of Millennials, with and without kids, expect to increase their spend on subscription OTT services in the 30 next 12 months (vs. 6% for Non- millennials). 20 10 0 Total Millennials Students Flat sharing Getting your Young families Young families Non-millennials at home own place (<25 years) (25 - 34) Millennials by life stage What are the key reasons Note: Q: Which of the following TV services do you use at home, or for your personal use? Option - “Subscription online video streaming services (e.g., Netflix, Amazon Prime Instant Video, Now TV, etc.)” for subscribing to OTT services? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

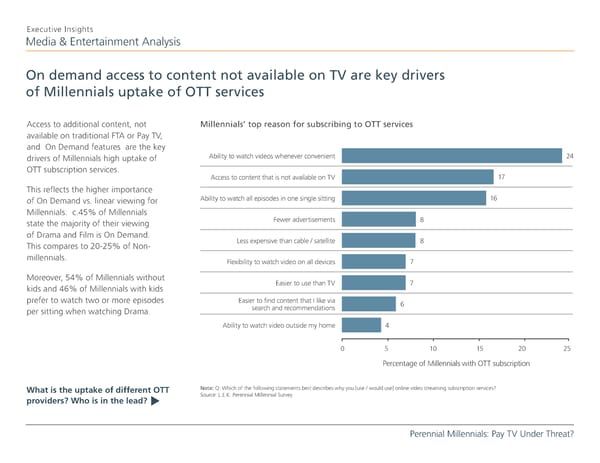

Executive Insights Media & Entertainment Analysis On demand access to content not available on TV are key drivers of Millennials uptake of OTT services Access to additional content, not Millennials’ top reason for subscribing to OTT services available on traditional FTA or Pay TV, and On Demand features are the key drivers of Millennials high uptake of Ability to watch videos whenever convenient 24 OTT subscription services. Access to content that is not available on TV 17 This reflects the higher importance of On Demand vs. linear viewing for Ability to watch all episodes in one single sitting 16 Millennials. c.45% of Millennials state the majority of their viewing Fewer advertisements 8 of Drama and Film is On Demand. Less expensive than cable / satellite 8 This compares to 20-25% of Non- millennials. Flexibility to watch video on all devices 7 Moreover, 54% of Millennials without Easier to use than TV 7 kids and 46% of Millennials with kids prefer to watch two or more episodes Easier to find content that I like via 6 per sitting when watching Drama. search and recommendations Ability to watch video outside my home 4 0 5 10 15 20 25 Percentage of Millennials with OTT subscription What is the uptake of different OTT Note: Q: Which of the following statements best describes why you [use / would use] online video streaming subscription services? Source: L.E.K. Perennial Millennial Survey providers? Who is in the lead? t Perennial Millennials: Pay TV Under Threat?

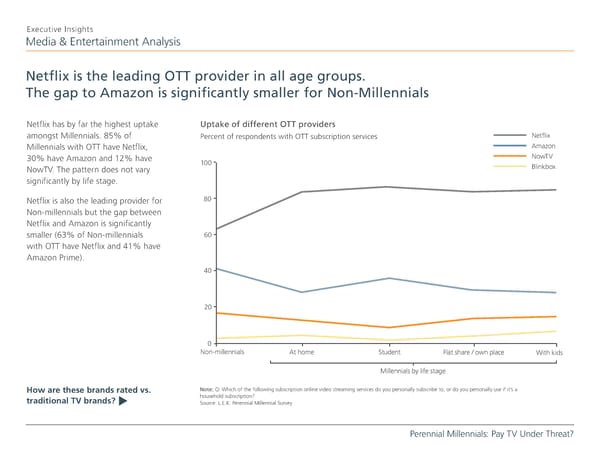

Executive Insights Media & Entertainment Analysis Netflix is the leading OTT provider in all age groups. The gap to Amazon is significantly smaller for Non-Millennials Netflix has by far the highest uptake Uptake of different OTT providers amongst Millennials. 85% of Percent of respondents with OTT subscription services Netflix Millennials with OTT have Netflix, Amazon 30% have Amazon and 12% have NowTV 100 Blinkbox NowTV. The pattern does not vary significantly by life stage. Netflix is also the leading provider for 80 Non-millennials but the gap between Netflix and Amazon is significantly smaller (63% of Non-millennials 60 with OTT have Netflix and 41% have Amazon Prime). 40 20 0 Non-millennials At home Student Flat share / own place With kids Millennials by life stage How are these brands rated vs. Note: Q: Which of the following subscription online video streaming services do you personally subscribe to, or do you personally use if it’s a household subscription? traditional TV brands? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

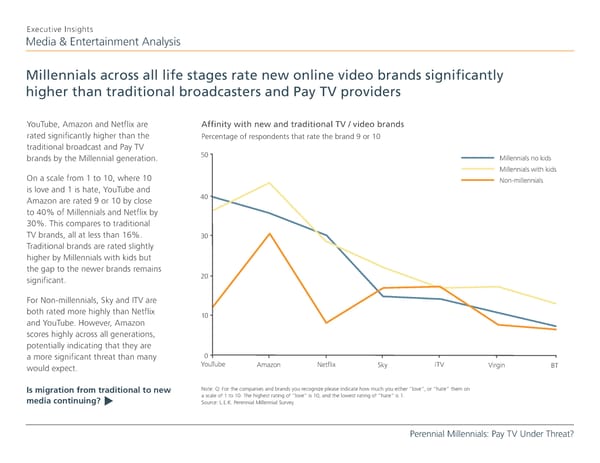

Executive Insights Media & Entertainment Analysis Millennials across all life stages rate new online video brands significantly higher than traditional broadcasters and Pay TV providers YouTube, Amazon and Netflix are Affinity with new and traditional TV / video brands rated significantly higher than the Percentage of respondents that rate the brand 9 or 10 traditional broadcast and Pay TV brands by the Millennial generation. 50 Millennials no kids Millennials with kids On a scale from 1 to 10, where 10 Non-millennials is love and 1 is hate, YouTube and Amazon are rated 9 or 10 by close 40 to 40% of Millennials and Netflix by 30%. This compares to traditional TV brands, all at less than 16%. 30 Traditional brands are rated slightly higher by Millennials with kids but the gap to the newer brands remains significant. 20 For Non-millennials, Sky and ITV are both rated more highly than Netflix 10 and YouTube. However, Amazon scores highly across all generations, potentially indicating that they are a more significant threat than many 0 would expect. YouTube Amazon Netflix Sky ITV Virgin BT Is migration from traditional to new Note: Q: For the companies and brands you recognize please indicate how much you either “love”, or “hate” them on a scale of 1 to 10. The highest rating of “love” is 10, and the lowest rating of “hate” is 1. media continuing? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

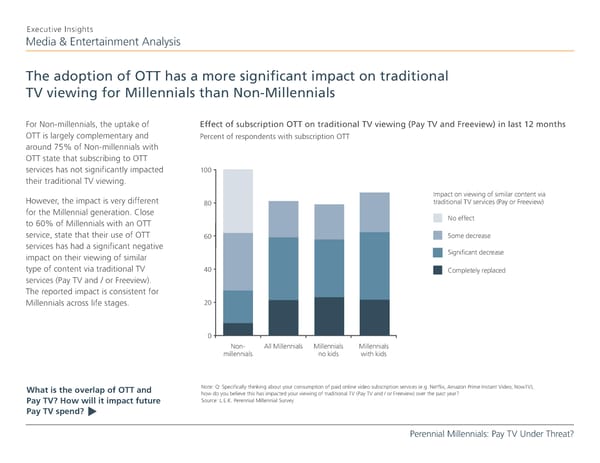

Executive Insights Media & Entertainment Analysis The adoption of OTT has a more significant impact on traditional TV viewing for Millennials than Non-Millennials For Non-millennials, the uptake of Effect of subscription OTT on traditional TV viewing (Pay TV and Freeview) in last 12 months OTT is largely complementary and Percent of respondents with subscription OTT around 75% of Non-millennials with OTT state that subscribing to OTT services has not significantly impacted 100 their traditional TV viewing. However, the impact is very different Impact on viewing of similar content via 80 traditional TV services (Pay or Freeview) for the Millennial generation. Close No effect to 60% of Millennials with an OTT service, state that their use of OTT 60 Some decrease services has had a significant negative Significant decrease impact on their viewing of similar type of content via traditional TV 40 Completely replaced services (Pay TV and / or Freeview). The reported impact is consistent for Millennials across life stages. 20 0 Non- All Millennials Millennials Millennials millennials no kids with kids What is the overlap of OTT and Note: Q: Specifically thinking about your consumption of paid online video subscription services (e.g. Netflix, Amazon Prime Instant Video, NowTV), how do you believe this has impacted your viewing of traditional TV (Pay TV and / or Freeview) over the past year? Pay TV? How will it impact future Source: L.E.K. Perennial Millennial Survey Pay TV spend? t Perennial Millennials: Pay TV Under Threat?

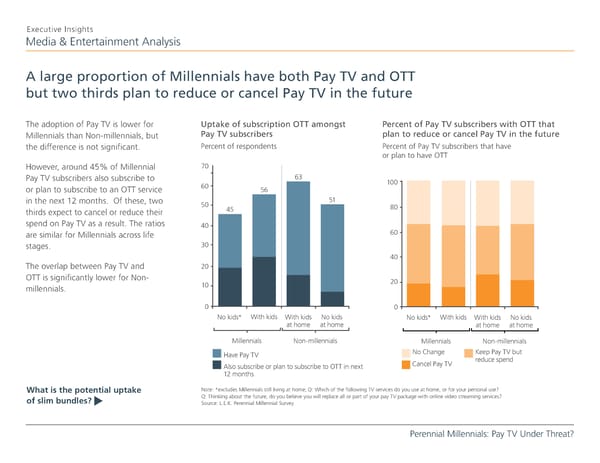

Executive Insights Media & Entertainment Analysis A large proportion of Millennials have both Pay TV and OTT but two thirds plan to reduce or cancel Pay TV in the future The adoption of Pay TV is lower for Uptake of subscription OTT amongst Percent of Pay TV subscribers with OTT that Millennials than Non-millennials, but Pay TV subscribers plan to reduce or cancel Pay TV in the future the difference is not significant. Percent of respondents Percent of Pay TV subscribers that have or plan to have OTT However, around 45% of Millennial 70 Pay TV subscribers also subscribe to 63 100 or plan to subscribe to an OTT service 60 56 in the next 12 months. Of these, two 50 51 thirds expect to cancel or reduce their 45 80 spend on Pay TV as a result. The ratios 40 are similar for Millennials across life 60 stages. 30 40 The overlap between Pay TV and 20 OTT is significantly lower for Non- 20 millennials. 10 0 0 No kids* With kids With kids No kids No kids* With kids With kids No kids at home at home at home at home Millennials Non-millennials Millennials Non-millennials Have Pay TV No Change Keep Pay TV but Cancel Pay TV reduce spend Also subscribe or plan to subscribe to OTT in next 12 months What is the potential uptake Note: *excludes Millennials still living at home; Q: Which of the following TV services do you use at home, or for your personal use? Q: Thinking about the future, do you believe you will replace all or part of your pay TV package with online video streaming services? of slim bundles? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

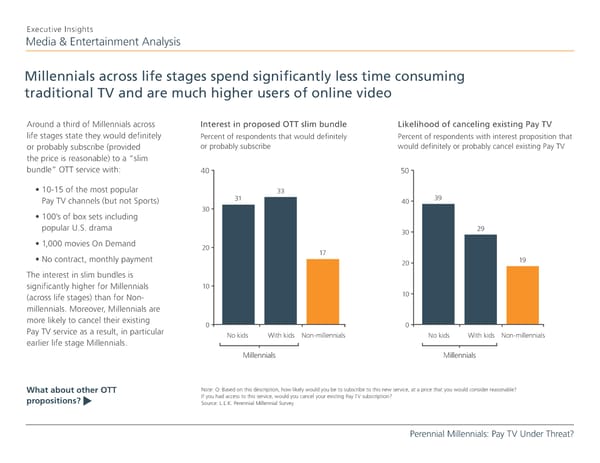

Executive Insights Media & Entertainment Analysis Millennials across life stages spend significantly less time consuming traditional TV and are much higher users of online video Around a third of Millennials across Interest in proposed OTT slim bundle Likelihood of canceling existing Pay TV life stages state they would definitely Percent of respondents that would definitely Percent of respondents with interest proposition that or probably subscribe (provided or probably subscribe would definitely or probably cancel existing Pay TV the price is reasonable) to a “slim bundle” OTT service with: 40 50 • 10-15 of the most popular 33 Pay TV channels (but not Sports) 31 40 39 30 • 100’s of box sets including popular U.S. drama 30 29 • 1,000 movies On Demand 20 • No contract, monthly payment 17 20 19 The interest in slim bundles is significantly higher for Millennials 10 (across life stages) than for Non- 10 millennials. Moreover, Millennials are more likely to cancel their existing 0 0 Pay TV service as a result, in particular No kids With kids Non-millennials No kids With kids Non-millennials earlier life stage Millennials. Millennials Millennials What about other OTT Note: Q: Based on this description, how likely would you be to subscribe to this new service, at a price that you would consider reasonable? If you had access to this service, would you cancel your existing Pay TV subscription? propositions? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

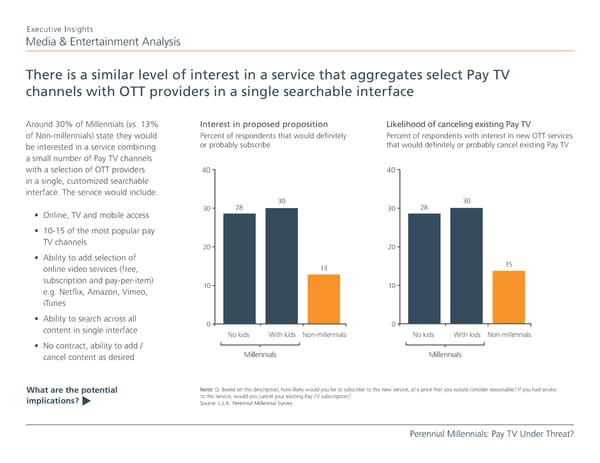

Executive Insights Media & Entertainment Analysis There is a similar level of interest in a service that aggregates select Pay TV channels with OTT providers in a single searchable interface Around 30% of Millennials (vs. 13% Interest in proposed proposition Likelihood of canceling existing Pay TV of Non-millennials) state they would Percent of respondents that would definitely Percent of respondents with interest in new OTT services be interested in a service combining or probably subscribe that would definitely or probably cancel existing Pay TV a small number of Pay TV channels with a selection of OTT providers 40 40 in a single, customized searchable interface. The service would include: 30 30 30 28 30 28 • Online, TV and mobile access • 10-15 of the most popular pay TV channels 20 20 • Ability to add selection of online video services (free, 13 15 subscription and pay-per-item) 10 10 e.g. Netflix, Amazon, Vimeo, iTunes • Ability to search across all 0 0 content in single interface No kids With kids Non-millennials No kids With kids Non-millennials • No contract, ability to add / cancel content as desired Millennials Millennials What are the potential Note: Q: Based on this description, how likely would you be to subscribe to this new service, at a price that you would consider reasonable? If you had access to this service, would you cancel your existing Pay TV subscription? implications? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

Executive Insights Media & Entertainment Analysis The research indicates that Pay TV operators face a growing threat from the Millennial generation’s preference for new media channels • Millennials across all life stages are already subscribing to OTT services at a higher rate of penetration than older generations • While subscription OTT services are largely complementary for Non-millennials, it has a significant negative impact on Millennials’ viewing of traditional TV services • A large proportion of Millennials have both Pay TV and OTT and two thirds of these believe they will cancel or reduce spend on Pay TV in the future • There is a strong interest in slim OTT bundles from Millennials What does this mean for the media industry? • Traditional media participants will need to adapt rapidly to compete in this fast-emerging new environment • There needs to be far further and faster innovation to develop propositions that capture the interest and behaviour patterns of the Millennial generation • There are continued opportunities for content providers to develop and monetize “must-have” content with strong appeal to the Millennial generations across new and traditional platforms About the authors t Perennial Millennials: Pay TV Under Threat?

Executive Insights Media & Entertainment Analysis Research Methodology For The Perennial Millennial, L.E.K. Consulting conducted online research of 1,308 Millennials and 685 Non-millennials living across the U.K. The research took place in September 2015. About the Authors Maria Palm is a partner at L.E.K. Consulting’s London office. She Martin Pilkington is a partner in L.E.K. Consulting’s London office has over 22 years of experience in the telecommunications and is one of the leaders of L.E.K.’s European Aviation & Travel and Media, industry and has assisted various clients with commercial due Entertainment & Technology practices. Martin has more than 22 years diligence, sales and distribution strategy, and valuation projects. o f experience helping clients address issues including growth strategy, Maria first worked for L.E.K. between 1993 and1997 before portfolio optimization, transactions, sales and marketing strategy, pricing, leaving to join British Telecommunications as a strategy manager. performance improvement, new product development and market She returned to L.E.K. London in 2000. entry strategy. About L.E.K. Consulting L.E.K. Consulting is a global management consulting firm that uses deep industry expertise and rigorous analysis to help business leaders achieve practical results with real impact. We are uncompromising in our approach to helping clients consistently make better decisions, deliver improved business performance and create greater shareholder returns. The firm advises and supports global companies that are leaders in their industries — including the largest private and public sector organizations, private equity firms and emerging entrepreneurial businesses. Founded more than 30 years ago, L.E.K. employs more than 1,200 professionals across the Americas, Asia-Pacific and Europe. For more information, go to www.lek.com. L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2016 L.E.K. Consulting LLC