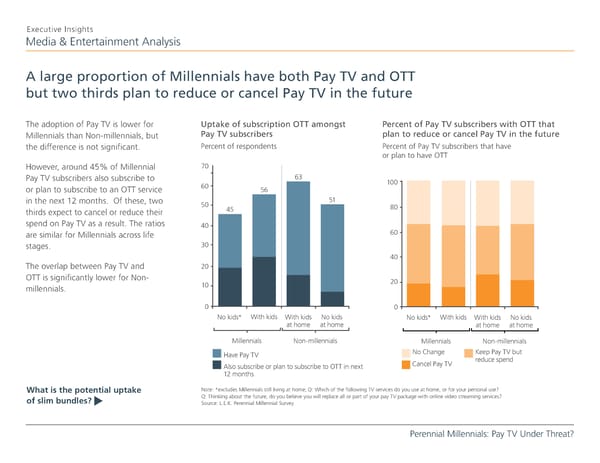

Executive Insights Media & Entertainment Analysis A large proportion of Millennials have both Pay TV and OTT but two thirds plan to reduce or cancel Pay TV in the future The adoption of Pay TV is lower for Uptake of subscription OTT amongst Percent of Pay TV subscribers with OTT that Millennials than Non-millennials, but Pay TV subscribers plan to reduce or cancel Pay TV in the future the difference is not significant. Percent of respondents Percent of Pay TV subscribers that have or plan to have OTT However, around 45% of Millennial 70 Pay TV subscribers also subscribe to 63 100 or plan to subscribe to an OTT service 60 56 in the next 12 months. Of these, two 50 51 thirds expect to cancel or reduce their 45 80 spend on Pay TV as a result. The ratios 40 are similar for Millennials across life 60 stages. 30 40 The overlap between Pay TV and 20 OTT is significantly lower for Non- 20 millennials. 10 0 0 No kids* With kids With kids No kids No kids* With kids With kids No kids at home at home at home at home Millennials Non-millennials Millennials Non-millennials Have Pay TV No Change Keep Pay TV but Cancel Pay TV reduce spend Also subscribe or plan to subscribe to OTT in next 12 months What is the potential uptake Note: *excludes Millennials still living at home; Q: Which of the following TV services do you use at home, or for your personal use? Q: Thinking about the future, do you believe you will replace all or part of your pay TV package with online video streaming services? of slim bundles? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

Perennial Millennials Page 8 Page 10

Perennial Millennials Page 8 Page 10