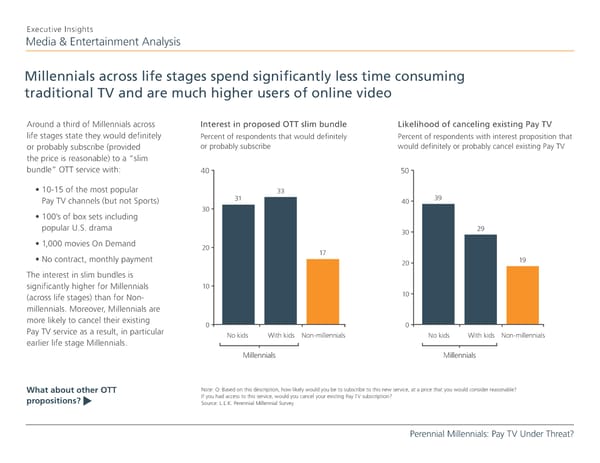

Executive Insights Media & Entertainment Analysis Millennials across life stages spend significantly less time consuming traditional TV and are much higher users of online video Around a third of Millennials across Interest in proposed OTT slim bundle Likelihood of canceling existing Pay TV life stages state they would definitely Percent of respondents that would definitely Percent of respondents with interest proposition that or probably subscribe (provided or probably subscribe would definitely or probably cancel existing Pay TV the price is reasonable) to a “slim bundle” OTT service with: 40 50 • 10-15 of the most popular 33 Pay TV channels (but not Sports) 31 40 39 30 • 100’s of box sets including popular U.S. drama 30 29 • 1,000 movies On Demand 20 • No contract, monthly payment 17 20 19 The interest in slim bundles is significantly higher for Millennials 10 (across life stages) than for Non- 10 millennials. Moreover, Millennials are more likely to cancel their existing 0 0 Pay TV service as a result, in particular No kids With kids Non-millennials No kids With kids Non-millennials earlier life stage Millennials. Millennials Millennials What about other OTT Note: Q: Based on this description, how likely would you be to subscribe to this new service, at a price that you would consider reasonable? If you had access to this service, would you cancel your existing Pay TV subscription? propositions? t Source: L.E.K. Perennial Millennial Survey Perennial Millennials: Pay TV Under Threat?

Perennial Millennials Page 9 Page 11

Perennial Millennials Page 9 Page 11